How are the funds constructed?

This is not a ‘quant’ fund.

The portfolio is based on human behaviour, not data mining. As such, there is no risk that the underlying principles will disappear. Nor is there a risk that the portfolio performance will swing around depending on what’s “in favour” (as you will see with value funds or growth funds: their performance will swing depending on perceptions of whether “it’s a value market” or “it’s a growth market”).

It is different from most other behavioural finance funds in the market.

Some funds manage money the way they always have, but pin a Behavioural Finance label on to enhance credibility.

More serious Behavioural Finance funds tend to focus on a lesson that Behavioural Finance teaches (e.g. “stocks underreact to news”) and then try to pick stocks on this basis – frequently introducing the very same biases that they are notionally trying to take advantage of.

Finally, most Behavioural Finance funds hold a large number of stocks. Rosevalley funds, on the other hand, are high-conviction (the most diversified fund holds 25 longs and 5 shorts).

The Rosevalley Funds take the predictions that come out of Behavioural Finance and turn these into a rules-based portfolio.

We draw on academic research to understand how investors behave and use these insights to construct portfolios.

Classical economic theory assumes human beings (including investors) behave in a rational, utility-maximizing way. One outcome of this assumption is efficient markets (i.e., the notion that asset prices at all times incorporate all available information about their value).

Behavioural Economics/Behavioural Finance has developed over the past 30 years, and replaces the assumption of rational investors with empirical observations about how people actually behave.

The result of irrational behaviour (but irrational in predictable ways) creates deviations in asset prices (again, in predictable ways), that the Rosevalley Funds take advantage of.

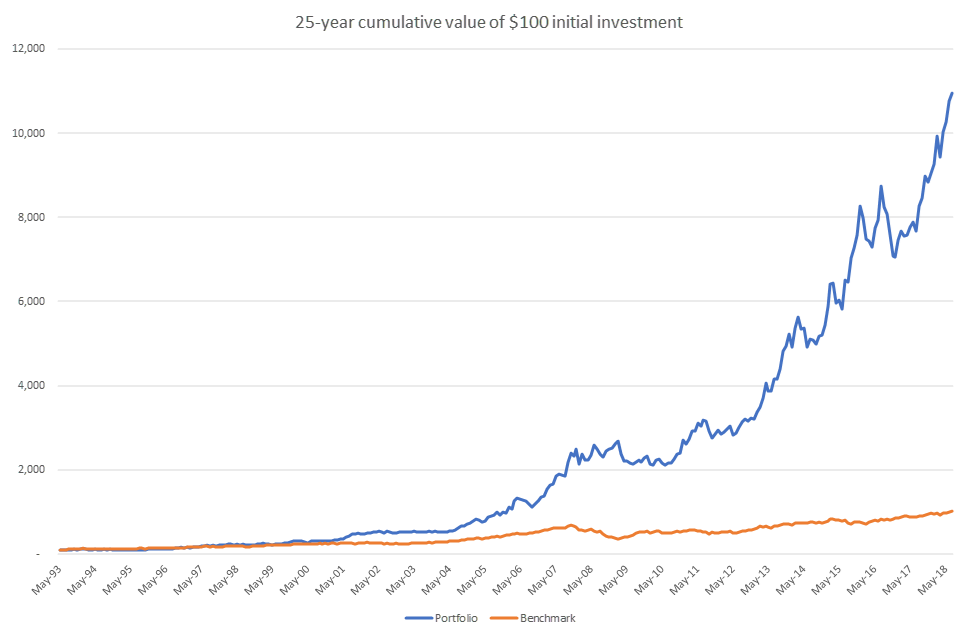

Our research shows that stock prices in Australia over the past 25-30 years have behaved in a manner that is consistent with the academic literature describing Behavioural Finance.

Interestingly, contrary to intuition and expectation, this effect has not been and actually cannot be completely arbitraged away. There is additional academic literature that explains why not.

In Australia, this effect tends to be even stronger than in other markets (it is not clear why, but a plausible explanation is that in Australia a larger part of the market is driven by individual investors than in most other markets).

We strongly believe that, since this approach takes human behaviour as its input, it is better underpinned and more robust than quant funds, which rely on historical correlations without an explanatory foundation.